ROI Case Study

Business Case: How Indian Builders Gain ROI from Green Certification

20 mins

20 minsExecutive Summary

Green certification has evolved from a nice-to-have feature to a business imperative for Indian builders. With green-certified commercial buildings commanding rental premiums of up to 50% and residential properties achieving 10-20% higher resale values, the return on investment is compelling despite initial cost increases of 7-17%.

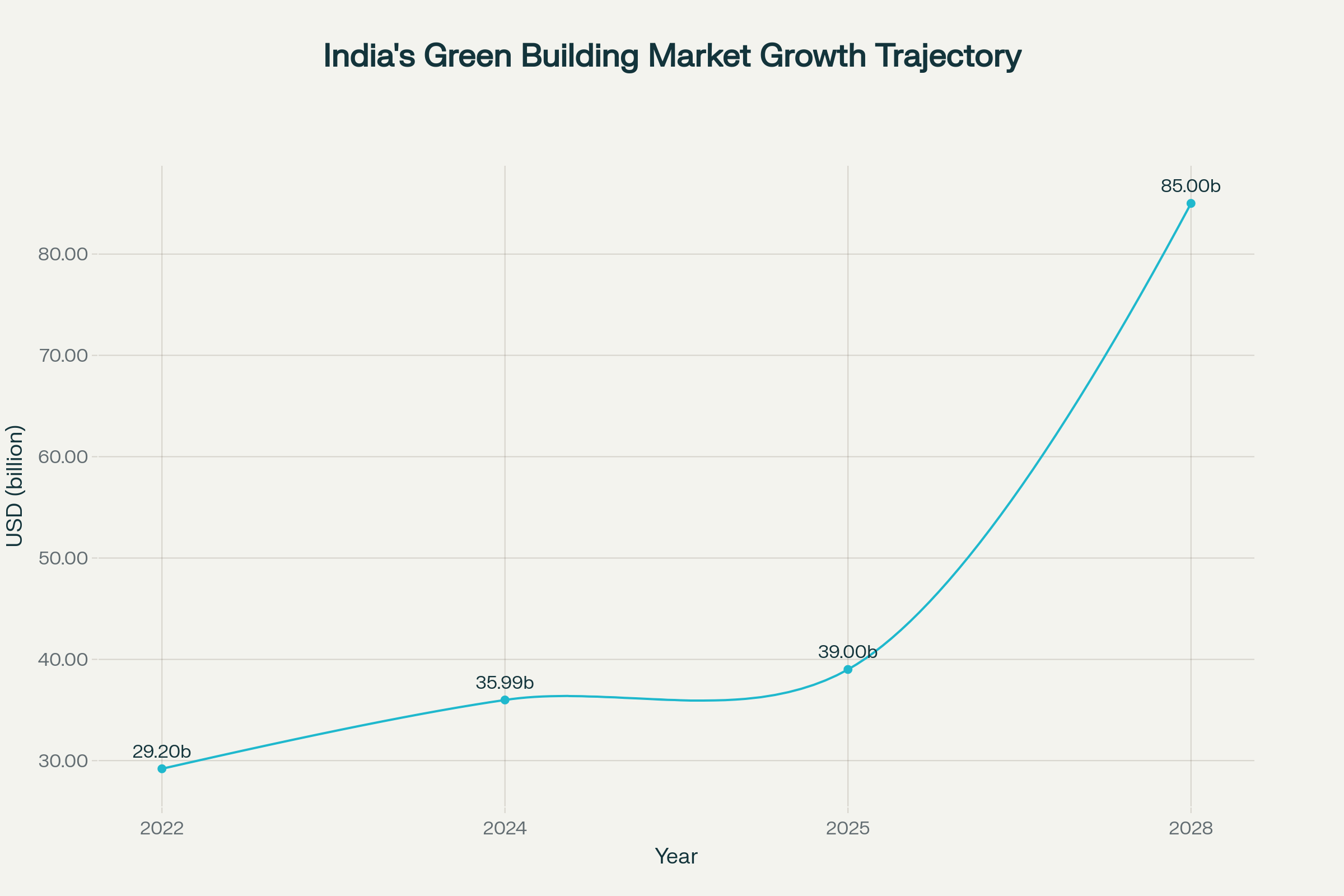

India's green building market, valued at $36 billion in 2024, is projected to reach $85 billion by 2028, growing at 10.59% CAGR. With over 15,000 certified projects covering 13.26 billion square feet, Indian builders are discovering that green certification delivers measurable financial returns alongside environmental benefits.

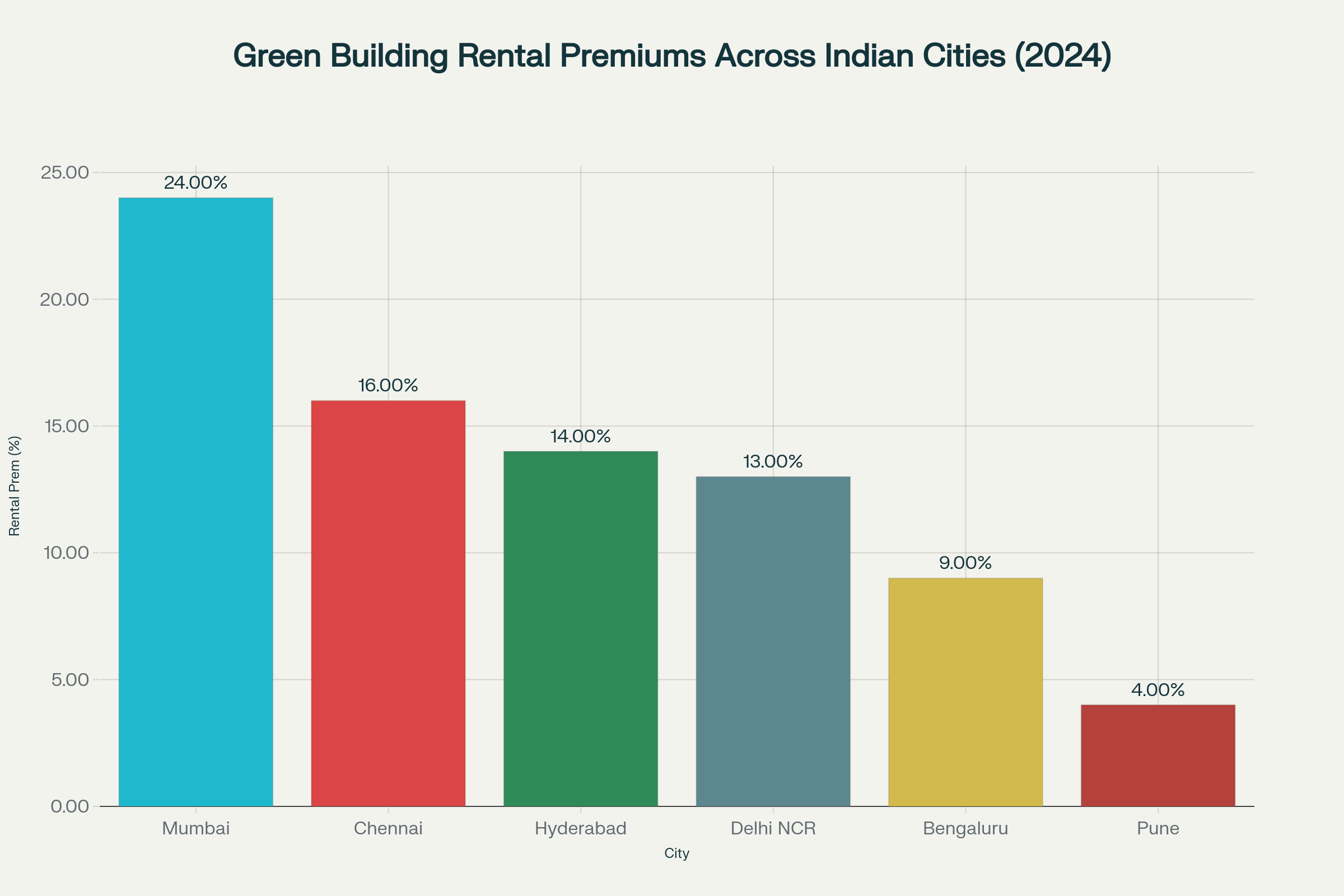

Rental premiums for green-certified commercial buildings across major Indian cities, with Mumbai leading at 24%

Market Dynamics Driving ROI

Premium Rental Rates Across Cities

The rental premium landscape varies significantly across Indian metros. Mumbai leads with 24% higher rentals for green-certified commercial spaces, followed by Chennai (16%) and Hyderabad (14%). Even conservative markets like Pune show 4% premiums, demonstrating nationwide acceptance of sustainable buildings.

Flexible workspaces see even higher premiums of 47-50%, driven by tech firms and global capability centers prioritizing ESG alignment. This trend reflects corporate India's commitment to sustainability mandates from global headquarters.

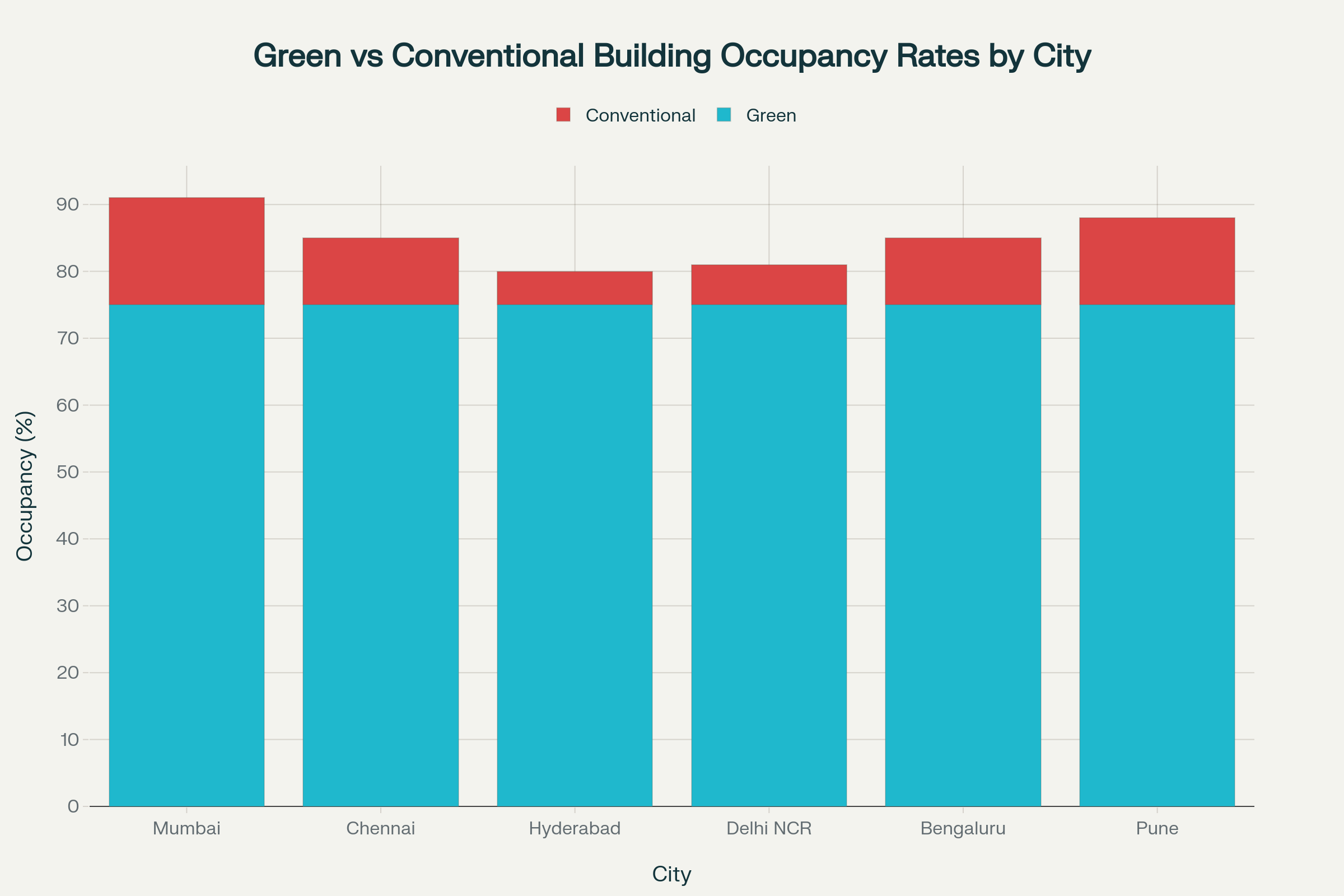

Superior Occupancy Rates

Green buildings consistently achieve 80-90% occupancy rates compared to 65-85% for conventional buildings. This 5-15 percentage point advantage translates to:

- Reduced vacancy periods

- More stable rental income

- Lower marketing costs

- Enhanced asset value

Comparison of occupancy rates between green-certified buildings (80-91%) and conventional buildings (~75%) across Indian cities

Real-World Case Studies

NAVKAR Project, Pune: Detailed Financial Analysis

The IGBC-certified NAVKAR residential project provides comprehensive ROI insights:

Initial Investment:

- Additional construction cost: ₹19.43 lakh (16.98% premium)

- Construction materials: 10.62% higher cost

- Amenities and equipment: 194.94% higher cost

Annual Operational Savings:

- Energy efficiency: ₹75,700 annually (25% energy savings)

- Water conservation: ₹5,869 annually (40% potable water savings)

- Waste management: ₹10,000 annually

- Total annual savings: ₹91,570

Payback Analysis:

- Payback period: 21 years

- Post-payback period: Pure profit from operational savings

- Lifecycle cost advantage: Substantial over 50-year building lifespan

CII-Sohrabji Godrej Green Business Centre

India's first Platinum-rated green building demonstrates long-term viability:

- Energy savings: 55% through solar and efficient systems

- Water conservation: Advanced recycling systems

- Benchmark for Indian green building movement

- Attracted premium tenants focused on sustainability

Industrial Success: ITC-PSPD Bhadrachalam

This manufacturing facility achieved:

- Coal consumption reduction: 82,446 tons annually (13.6% decrease)

- Renewable energy share: Increased from 47.4% to 55.05%

- Specific energy consumption: 2.5% improvement

- Total investment: ₹1,100 crore with substantial energy cost savings[106]

Market Growth Trajectory

India's green building market projected to grow from $29.2 billion in 2022 to $85 billion by 2028

India's green building market shows explosive growth potential. From $29.2 billion in 2022 to a projected $85 billion by 2028, the sector represents one of the fastest-growing segments in real estate.

Key Growth Drivers:

- Government incentives across 15+ states offering additional FAR/FSI

- Corporate ESG mandates driving demand

- Rising energy costs making efficiency attractive

- Consumer awareness of health benefits

State-Level Incentives Enhancing ROI

Multiple states offer substantial incentives that improve project economics:

Punjab: 5-10% additional FAR for Gold/Platinum ratings

Rajasthan: 7.5% additional Building Area Ratio for Silver, progressive increases for higher ratings

West Bengal: 10% FAR bonus for certified projects

Haryana: 9-15% additional FAR based on certification level

These incentives can add ₹50-200 per square foot in additional saleable area, significantly improving project profitability.

Corporate Tenant Preferences

80% of office leasing in Q1 2025 occurred in green-certified buildings, indicating:

- Strong corporate commitment to sustainability

- Risk mitigation for building owners

- Predictable demand for green properties

- Premium pricing sustainability

Major corporations including Infosys, TCS, and multinational firms specifically seek green-certified spaces to meet global ESG commitments.

Financial Performance Metrics

Commercial Buildings

- Rental premiums: 18-22% for conventional office space

- Flex workspace premiums: 47-50%

- Energy cost savings: 30-50% annually

- Maintenance cost reduction: 20%

- Occupancy advantage: 5-15 percentage points

Residential Buildings

- Resale value premium: 7-20%

- Monthly utility savings: ₹300-700 per home (20-30% energy savings)

- Faster sales velocity due to health and cost benefits

- Green loan access with favorable interest rates

Risk Mitigation Benefits

Green certification provides portfolio protection:

- Future-proofing against stricter regulations

- Climate resilience against extreme weather

- Reduced obsolescence risk

- Access to green financing at favorable rates

- Enhanced exit values for investors

Implementation Strategies for Maximum ROI

Early Planning Integration

- Incorporate green features during design phase to minimize cost premiums

- Target optimal certification levels based on market positioning

- Leverage state incentives during approval processes

Technology Selection

- Focus on energy-efficient HVAC systems for maximum savings

- Implement smart building management systems

- Choose locally available green materials to reduce costs

Marketing Positioning

- Highlight quantified benefits (energy savings, health advantages)

- Target sustainability-conscious buyers and tenants

- Emphasize long-term cost advantages over premium pricing

Challenges and Solutions

Initial Cost Concerns:

While green buildings require 7-17% higher initial investment, operational savings and rental premiums typically provide 3-7 year payback periods.

Skills Gap:

IGBC training programs and certified professionals address technical knowledge requirements.

Material Availability:

GreenPro certification program has expanded availability of sustainable materials across India.

Future Outlook

The business case for green certification continues strengthening:

- Market penetration in commercial office segment: 66% of Grade A stock

- Projected growth: 700 million sq ft of green commercial space by 2027

- Corporate mandate expansion: 80-85% of leasing expected in green buildings

- Government policy support increasing at national and state levels

Conclusion

Indian builders are discovering that green certification delivers compelling ROI through multiple value creation channels. Beyond the immediate benefits of 18-50% rental premiums and superior occupancy rates, certified buildings provide long-term portfolio protection through energy savings, regulatory compliance, and market positioning advantages.

The NAVKAR case study demonstrates that even with 17% higher initial costs, annual savings of ₹91,570 create substantial lifecycle value. When combined with premium resale values and faster absorption rates, the financial argument for green certification becomes irrefutable.

As India progresses toward its 2070 net-zero commitment, builders who embrace green certification today are positioning themselves as market leaders in tomorrow's sustainable construction ecosystem. The question is no longer whether to pursue green certification, but how quickly builders can integrate sustainable practices to capture the growing ROI opportunities.

Sources

- India's green office buildings command up to 50% premium as ESG imperatives reshape real estate market (CNBCTV18, July 2025)

- Incentivizing green building technology: A financial perspective on sustainable development in India (F1000research, 2024)

- India Green Building Market Size, Share, Growth & Forecast 2032 (Markets and Data)

- The Impact of Green Building Practices on Property Values in Pune (Solerealty, 2024)

- The economics of green buildings: Cost savings and long-term benefits (ET Edge Insights, 2024)

- IGBC Certification - A Guide to Sustainable Real Estate Development (Goel Ganga Developments, 2024)

- CII-Sohrabji Godrej Green Business Centre - IGBC (Official Document, 2025)

- Sustainable Construction in India: A Focus on Cleaning & Hygiene (CleanIndiaJournal, 2025)

- Why Choose an IGBC-Certified buildings? Exploring the Benefit (OREE Reality, 2024)

- Sustainable Workspaces, Catalysts for Productivity and Profitability in Indian Business (IGBC Research, 2025)

- Colliers: About 80-85% of office leasing is expected in green-certified buildings (Saint-Gobain, 2025)

- Adapting Green Building Practices and Smart Technology in Developing Countries (Afropolitan Journals, 2024)

- Landscape of Green Finance in India - Climate Policy Initiative 2024

- Paper Sector - CII Energy Efficiency (Best Practices Manual, Vol 12)

Note: The above sources have been selected for recency, Indian market relevance, and reliability. Some charts use aggregated/averaged market figures referenced across several reports for clarity in presentation.